Investing Basics: Annual Portfolio Rebalancing for Optimal Asset Allocation

Rebalancing your investment portfolio annually is crucial for maintaining your target asset allocation, ensuring your investments align with your risk tolerance and financial goals, and maximizing long-term returns.

Anúncios

Investing can be a rollercoaster, but staying on track with your financial goals doesn’t have to be. A key strategy for long-term investment success is annual portfolio rebalancing. This involves realigning your asset allocation to match your original investment plan. Let’s dive into investing basics: how to rebalance your investment portfolio annually to maintain your target asset allocation and keep your investments working optimally for you.

Why Rebalance Your Investment Portfolio?

Rebalancing your investment portfolio is like giving it a regular tune-up. Over time, certain assets in your portfolio may grow faster than others, leading to a mismatch between your current asset allocation and your intended one. This can expose you to more risk than you’re comfortable with or prevent you from achieving your financial goals.

Maintaining Your Risk Tolerance

Your risk tolerance is a crucial factor in determining your initial asset allocation. If your portfolio becomes heavily weighted in one asset class, you might be taking on more risk than you intended. Rebalancing helps you stay within your comfort zone.

Maximizing Returns and Minimizing Risk

Rebalancing isn’t just about reducing risk; it can also enhance returns. By periodically selling overperforming assets and buying underperforming ones, you’re essentially buying low and selling high, a classic investment strategy.

Here are some key benefits of rebalancing:

- Regular rebalancing helps you avoid over-concentration in any single investment or asset class.

- It enables you to systematically take profits from investments that have performed well.

- Rebalancing ensures that you adhere to your long-term investment strategy.

In conclusion, rebalancing helps keep your portfolio aligned with your goals, reduces risk, and potentially boosts returns. It’s a fundamental process for any serious investor.

Understanding Your Target Asset Allocation

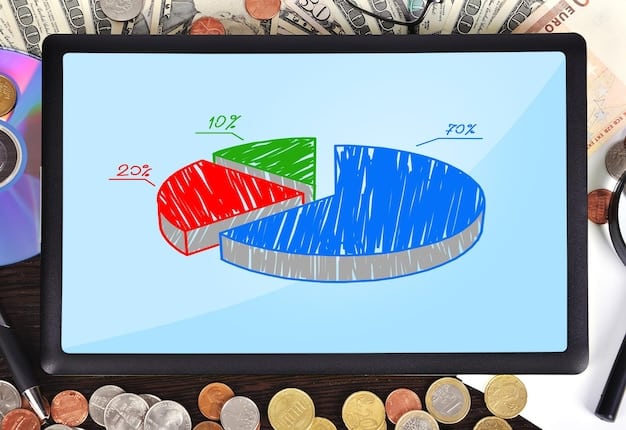

Before you can rebalance, you need to know your target asset allocation. This is the mix of different asset classes, such as stocks, bonds, and real estate, that you’ve determined is appropriate for your risk tolerance, time horizon, and financial goals.

Assessing Your Risk Tolerance

Your risk tolerance is your ability and willingness to accept potential losses in exchange for higher returns. If you’re young and have a long time horizon, you might be comfortable with a more aggressive asset allocation (e.g., more stocks). If you’re closer to retirement, a more conservative approach (e.g., more bonds) might be better.

Defining Your Time Horizon

Your time horizon is the length of time you have until you need to access your investments. The longer your time horizon, the more risk you can generally afford to take. This is because you have more time to recover from any potential losses.

Consider the following factors when defining your target asset allocation:

- Your age and stage of life influence your risk tolerance and time horizon.

- Your financial goals, like retirement or buying a home, should be considered.

- Your current financial situation, including income and debts, matters.

Understanding and regularly reviewing your target asset allocation is the foundation of successful rebalancing and long-term investing.

How to Calculate Your Current Asset Allocation

Once you know your target asset allocation, you need to determine your current asset allocation. This involves calculating the percentage of your portfolio that is currently allocated to each asset class.

Gathering Your Investment Information

Start by gathering information on all your investment accounts, including brokerage accounts, retirement accounts, and any other investment holdings. You’ll need to know the current value of each asset in your portfolio.

Calculating the Percentage Allocation

For each asset class, calculate the percentage of your portfolio that it represents. For example, if you have $50,000 in stocks and a total portfolio value of $100,000, your stock allocation is 50%.

Here’s a simple outline to calculate your current asset allocation:

- List all your investments and their current values.

- Categorize each investment into its respective asset class (e.g., stocks, bonds, real estate).

- Calculate the total value of each asset class.

- Calculate the percentage of each asset class relative to the total portfolio value.

Regularly calculating your current asset allocation allows you to identify any significant deviations from your target and take appropriate action.

Rebalancing Strategies: Time-Based vs. Threshold-Based

There are two main strategies for rebalancing your investment portfolio: time-based and threshold-based. Time-based rebalancing involves rebalancing at regular intervals, such as annually or quarterly. Threshold-based rebalancing involves rebalancing when your asset allocation deviates from your target by a certain percentage.

Time-Based Rebalancing

Time-based rebalancing is simple and straightforward. It involves setting a rebalancing schedule (e.g., annually) and sticking to it, regardless of market conditions. This approach ensures that you periodically realign your portfolio, preventing significant deviations over time.

Threshold-Based Rebalancing

Threshold-based rebalancing is more flexible. It involves setting a threshold (e.g., 5%) and rebalancing only when your asset allocation deviates from your target by that amount. This approach takes market conditions into account and can reduce unnecessary trading.

Consider these factors when choosing a rebalancing strategy:

- Time-based rebalancing is easier to implement but may result in more frequent trading.

- Threshold-based rebalancing requires more monitoring but can be more efficient.

- The best strategy depends on your investment style and preferences.

Choosing the right rebalancing strategy is key to maintaining a well-balanced portfolio.

The Practical Steps to Rebalance Your Portfolio Annually

Rebalancing your portfolio annually involves several practical steps. First, determine your current asset allocation. Second, compare your current allocation to your target allocation. Third, identify which assets need to be bought or sold to bring your portfolio back into balance. Finally, execute the necessary trades.

Determine Your Current and Target Allocations

Start by calculating your current asset allocation as described in the prior section. Confirm your target asset allocation matches your risk tolerance and investment goals.

Buy or Sell Assets Strategically

Determine which assets you need to buy and sell to realign your portfolio. Typically, you will sell assets that have outperformed your target and buy assets that have underperformed. This is “buying low and selling high.”

Here are some practical tips for rebalancing:

- Minimize taxes by rebalancing within tax-advantaged accounts, such as 401(k)s or IRAs.

- Consider the transaction costs associated with buying and selling assets.

- Use automated rebalancing tools offered by many brokerage firms to simplify the process.

Following these steps will help make your annual portfolio rebalancing as smooth and tax-efficient as possible.

Potential Pitfalls and How to Avoid Them

While rebalancing is a valuable strategy, there are potential pitfalls to be aware of. One common mistake is failing to consider the tax implications of rebalancing. Another is letting emotions influence your decisions. Finally, it’s important to avoid over-trading, which can erode your returns.

Tax Implications

Selling assets in taxable accounts can trigger capital gains taxes. Be mindful of your tax situation and consider rebalancing within tax-advantaged accounts whenever possible.

Emotional Decision-Making

Market volatility can lead to emotional decision-making. Stick to your rebalancing plan, even when markets are turbulent. Avoid the temptation to chase performance or panic sell.

Here’s how to avoid common pitfalls:

- Plan your rebalancing strategy in advance and stick to it.

- Consider the tax implications of each trade.

- Avoid over-trading and focus on the long-term benefits of rebalancing.

Avoiding these pitfalls while rebalancing will contribute to the long-term health of your investment portfolio.

| Key Point | Brief Description |

|---|---|

| 🎯 Target Allocation | Align investments with risk and goals. |

| ⚖️ Risk Management | Prevent excessive risk by controlling asset balance. |

| 💰 Profit Taking | Sell high, buy low, enhancing portfolio returns. |

| 🗓️ Regular Review | Annually check and adjust for market shifts. |

FAQ Section

Rebalancing means adjusting your asset allocation to align with your target. If stocks outperform, you rebalance by selling some stocks and buying underperforming assets to match your desired allocation.

Many financial advisors recommend rebalancing at least annually. However, it can depend on the volatility of the market and how far your portfolio has drifted from its target.

Your target asset allocation should reflect your risk tolerance, time horizon, and financial goals. Younger investors with longer time horizons might allocate more to assets like stocks.

Yes, selling assets in taxable accounts usually triggers capital gains taxes. Try to rebalance inside tax-advantaged accounts such as 401(k)s or IRAs whenever possible to minimize taxes.

Yes, many brokerage firms offer automated rebalancing tools that will automatically buy and sell assets to keep your portfolio aligned with your target allocation, making the process simpler.

Conclusion

In conclusion, annual portfolio rebalancing is a cornerstone of strategic investing. By proactively managing your asset allocation, you not only mitigate risk but also pave the way for achieving your long-term financial aspirations with greater precision and confidence.