Budgeting Apps Compared: Find the Perfect Fit for Your Finances

Choosing the right budgeting app depends on your individual financial goals and needs, with options ranging from simple expense trackers to comprehensive financial planning tools.

Anúncios

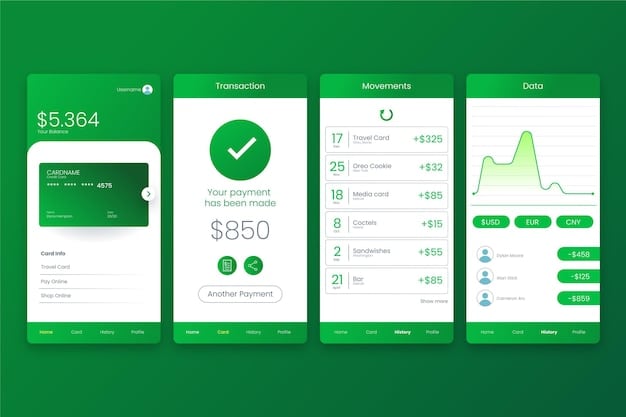

Navigating the world of personal finance can feel overwhelming, but with the right tools, you can gain control of your money and achieve your financial aspirations. One of the most effective tools in your arsenal is a budgeting app compared: which one is right for your financial goals?. These apps offer a convenient and insightful way to track your spending, create budgets, and identify areas where you can save.

Why Use a Budgeting App?

Budgeting apps have revolutionized how people manage their finances. Instead of relying on spreadsheets or mental calculations, these apps offer a user-friendly, automated way to track every dollar that comes in and goes out. This makes it easier than ever to stay on top of your financial health.

Convenience and Accessibility

One of the primary benefits of using a budgeting app is convenience. Most apps are available on both iOS and Android, allowing you to monitor your finances anytime, anywhere. They sync with your bank accounts and credit cards, automatically categorizing transactions and providing you with real-time insights.

Tracking Spending Habits

Budgeting apps excel at identifying your spending patterns. By automatically categorizing your transactions, they show you exactly where your money is going each month. This awareness is crucial for making informed decisions about your spending habits.

- See where your money goes: By categorizing transactions, you can see how much you spend on groceries, transportation, and entertainment.

- Identify areas for savings: This awareness reveals areas where you can cut back and save more money.

- Make informed decisions: With clear insights, you can make better financial choices.

Budgeting apps provide a clear, concise view of your financial situation, helping you to make informed decisions and achieve your financial goals. By understanding your spending habits and utilizing the features of these apps, you can take control of your money and build a more secure financial future.

Key Features to Look For in a Budgeting App

When choosing a budgeting app, it’s essential to consider the features that align with your specific needs and financial goals. Not all apps are created equal, and some offer features that others don’t. Understanding these features can help you make an informed decision.

Automatic Transaction Tracking

One of the most crucial features is automatic transaction tracking. This feature connects to your bank and credit card accounts, automatically importing and categorizing your transactions. It saves time and ensures accuracy in monitoring your spending.

Budgeting and Goal Setting

The ability to set budgets and financial goals is vital. Look for apps that allow you to create custom budgets for different spending categories, such as groceries, dining out, and entertainment. Goal-setting features help you plan for long-term objectives like buying a home or retirement.

- Customizable budgets: Set budgets for various spending categories.

- Financial goals: Plan for long-term objectives like retirement.

- Progress tracking: Monitor your progress towards your goals.

By ensuring the budgeting app you choose has these key features, you can customize your financial management approach and achieve your financial goals more efficiently. It’s about finding a tool that works for you and offers the functionalities needed to navigate your financial journey.

Mint: Overview, Pros, and Cons

Mint is one of the most popular budgeting apps available, known for its user-friendly interface and comprehensive features. It’s a free app that consolidates all your financial accounts into one place, making it easy to track your spending, create budgets, and monitor your credit score.

Pros of Using Mint

Mint offers several advantages that make it a top choice for many users. Its free nature, user-friendly interface, and comprehensive features are significant selling points.

Cons of Using Mint

Despite its popularity, Mint has some downsides. Users have raised concerns about data privacy and security. Here are some of the disadvantages of using Mint.

- Free to use: Mint is one of the few free apps available.

- User-friendly interface: The app is intuitive and easy to navigate.

- Comprehensive features: Mint offers a wide range of budgeting and tracking tools.

Mint is a great choice for anyone looking for a free, user-friendly budgeting app with comprehensive features. It consolidates all your financial data into one place, making it easy to track spending, create budgets, and monitor your credit score. However, those concerned about data privacy may want to consider a paid alternative with stronger security measures.

YNAB (You Need a Budget): Overview, Pros, and Cons

YNAB, or You Need a Budget, is a budgeting app that focuses on proactive money management. Unlike apps that primarily track past spending, YNAB helps you plan every dollar’s purpose before you spend it, promoting mindful spending habits.

Pros of Using YNAB

YNAB offers several distinct advantages that appeal to users seeking a proactive approach to budgeting. Its core philosophy revolves around four simple rules that help users gain control of their finances.

Cons of Using YNAB

Despite its many benefits, YNAB also has some drawbacks. Its subscription fee may be a barrier for some users, and the learning curve can be steep for those new to proactive budgeting.

YNAB is a powerful budgeting tool for those committed to proactive money management. Its focus on planning and mindful spending can help users gain control of their finances and achieve their financial goals. However, the subscription fee and learning curve may deter some potential users.

Personal Capital: Overview, Pros, and Cons

Personal Capital is a budgeting and wealth management app designed to provide a comprehensive view of your financial life. It’s particularly useful for individuals with investments, as it offers robust portfolio tracking and analysis tools, in addition to budgeting features.

Pros of Using Personal Capital

Personal Capital provides several features that make it appealing, especially for those with investments. Its ability to track net worth, analyze investment performance, and offer personalized financial advice are significant advantages.

Cons of Using Personal Capital

Despite its strengths, Personal Capital also has some drawbacks. Its focus on investment management means its budgeting features are not as robust as those of dedicated budgeting apps like Mint or YNAB.

- Holistic view: Personal Capital aggregates all your financial accounts into one dashboard.

- Investment tracking: robust tools for analyzing investment performance.

- Free financial advice: The app can connect with financial advisors

Quicken Simplifi: Overview, Pros, and Cons

Quicken Simplifi is a modern budgeting app designed for simplicity and ease of use. It offers a clean interface and focuses on helping users track their spending, set goals, and manage their finances without overwhelming complexity.

Pros of Using Quicken Simplifi

Quicken Simplifi stands out due to its user-friendly design and emphasis on simplicity. This makes it an excellent choice for individuals who find other budgeting apps too complicated or overwhelming. Simplifi emphasizes a clean, intuitive design, making it easy for users to navigate and understand their financial data.

Cons of Using Quicken Simplifi

While Quicken Simplifi offers many benefits, it also has some drawbacks. Its simplicity means it may lack some of the advanced features found in more comprehensive budgeting apps.

| Key Point | Brief Description |

|---|---|

| 💰Tracking Spending | Apps help monitor where your money goes. |

| 🎯 Goal Setting | Set financial goals like saving for a home. |

| 📊 Investment Tracking | Personal Capital offers robust investment analysis. |

| ✅ Simplification | Quicken Simplifi offers a clean, user-friendly interface. |

Frequently Asked Questions (FAQ)

▼

A budgeting app is a digital tool that helps you track your income, expenses, and savings. It typically connects to your bank accounts and credit cards to automatically import transactions and provide insights into your spending habits.

▼

Most reputable budgeting apps use encryption and secure connections to protect your financial data. However, it’s essential to review the app’s security measures and privacy policy before entrusting it with your information.

▼

While budgeting apps don’t directly improve your credit score, they can help you manage your finances more effectively. By tracking your spending and creating budgets, you can avoid late payments and keep your credit utilization low, which can positively impact your credit score.

▼

It’s a good practice to check your budgeting app regularly, ideally a few times a week. This allows you to stay on top of your spending, identify any unusual transactions, and make necessary adjustments to your budget.

▼

Some budgeting apps allow you to manually enter your transactions, although this can be more time-consuming. Alternatively, you can use privacy-focused apps that don’t require direct access to your bank accounts.

Conclusion

Choosing the right budgeting app is a personal decision that depends on your unique financial situation, goals, and preferences. By evaluating your needs and considering the pros and cons of each app, you can find the perfect tool to help you take control of your finances and achieve your financial aspirations.