Dollar-Cost Averaging: Reduce Investment Risk and Maximize Returns

Dollar-cost averaging is an investment strategy where a fixed amount of money is invested at regular intervals, regardless of the asset’s price, effectively reducing the risk of investing a large sum at a market peak and averaging out the purchase price over time.

Anúncios

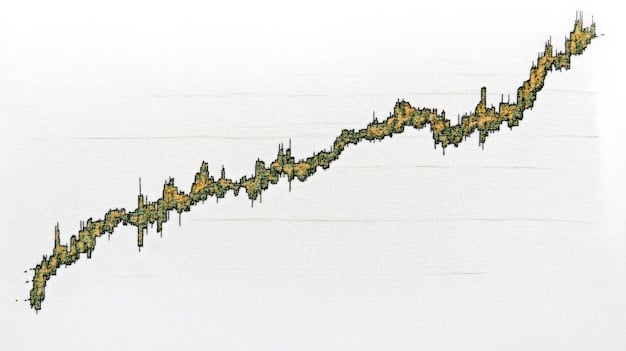

Investing can seem daunting, especially with market volatility. But what if there was a strategy to ease those anxieties and potentially enhance your returns? Enter **dollar-cost averaging**, a simple yet powerful technique that can significantly reduce your investment risk.

Understanding the Basics of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a method of investing a fixed amount of money into a particular investment at regular intervals over a period of time, regardless of the asset’s price. This strategy aims to reduce the impact of volatility on the overall purchase price of the assets.

How Dollar-Cost Averaging Works

The core principle is to invest a consistent dollar amount regularly, which means you’ll purchase more shares when prices are low and fewer when prices are high. This can lead to a lower average cost per share over time, compared to buying all the shares at once.

Benefits of Dollar-Cost Averaging

- Reduces Risk: By spreading purchases over time, DCA minimizes the risk of investing a large sum right before a market downturn.

- Emotional Discipline: It helps investors avoid making emotional decisions based on market fluctuations.

- Simplicity: DCA is easy to understand and implement, making it accessible for both beginners and experienced investors.

In essence, dollar-cost averaging is a disciplined approach that balances risk and reward, making it a cornerstone strategy for long-term investors.

Dollar-Cost Averaging vs. Lump-Sum Investing

When it comes to investing, particularly for long-term goals such as retirement, there are two primary strategies investors consider: dollar-cost averaging (DCA) and lump-sum investing. Understanding the difference between these approaches is crucial for making informed decisions about how to deploy your capital.

Lump-Sum Investing Explained

Lump-sum investing involves investing a single, large sum of money into the market all at once. The potential advantage of this strategy is that if the market trends upward over time, the investor could see substantial returns. However, it also carries the risk of investing right before a market decline, which could significantly impact the initial investment.

When to Choose Dollar-Cost Averaging

DCA is generally favored when investors are hesitant about the current market conditions or have a large sum of money to invest but are concerned about potential market volatility. By spreading the investment over time, DCA aims to reduce the risk associated with market timing.

Comparing the Two Strategies

- Risk Tolerance: DCA is suited for risk-averse investors, while lump-sum investing is more appropriate for those with a higher risk tolerance.

- Market Conditions: Lump-sum investing tends to outperform DCA in consistently rising markets, but DCA can be beneficial in volatile or declining markets.

- Psychological Comfort: DCA can provide psychological comfort by reducing the fear of making a large investment mistake at the wrong time.

The choice between DCA and lump-sum investing depends largely on individual circumstances, risk tolerance, and market outlook, highlighting the importance of a tailored investment approach.

The Psychological Benefits of Dollar-Cost Averaging

Investing isn’t just about numbers and charts; it’s also deeply intertwined with our emotions. Fear and greed can often drive impulsive decisions that undermine our investment goals. This is where dollar-cost averaging (DCA) shines, offering not only financial benefits but also significant psychological advantages.

Reducing Investment Anxiety

One of the most significant psychological benefits of DCA is its ability to reduce anxiety associated with market volatility. Knowing that you are investing a fixed amount at regular intervals, regardless of market peaks and dips, can provide a sense of control and stability. This can be particularly helpful for investors who are new to the market or those who tend to worry about short-term market fluctuations.

Combating Emotional Investing

DCA encourages a disciplined approach to investing, which can help you avoid making emotional decisions. Instead of trying to time the market, you’re following a predetermined plan. This can protect you from the urge to sell low during downturns or buy high during market frenzies.

Promoting Long-Term Focus

By focusing on consistent, regular investments, DCA promotes a long-term perspective. This helps you stay focused on your ultimate financial goals rather than getting caught up in short-term market noise. This long-term view is essential for building wealth and achieving financial success.

- Improved Sleep: Less worry about market timing can lead to better sleep and overall well-being.

- Increased Confidence: Sticking to a plan, even during turbulent times, builds confidence in your investment strategy.

- Less Stress: Removing the pressure to perfectly time the market reduces stress and improves your overall quality of life.

In conclusion, dollar-cost averaging provides a framework that fosters emotional stability, reduces anxiety, and promotes a long-term investment mindset, ultimately contributing to a more positive and successful investment experience.

Implementing a Dollar-Cost Averaging Strategy: A Step-by-Step Guide

Embarking on a dollar-cost averaging (DCA) strategy can be a straightforward yet effective way to build your investment portfolio. However, success with DCA requires a clear plan and consistent execution. Here’s a step-by-step guide to help you get started:

Step 1: Determine Your Investment Amount

Begin by deciding how much you can realistically invest on a regular basis. This amount should be comfortable within your budget and not compromise your ability to meet other financial obligations. Consider automating your contributions to ensure consistency.

Step 2: Choose Your Investment Vehicle

Select the investment(s) you want to allocate your funds to. This could be anything from stocks and bonds to mutual funds and ETFs. Ensure your chosen investments align with your risk tolerance and long-term goals.

Step 3: Set Your Investment Schedule

Decide on the frequency of your investments. Whether it’s weekly, bi-weekly, or monthly, consistency is key. Stick to your schedule regardless of market conditions to reap the benefits of DCA.

Step 4: Automate Your Investments

To simplify the process and ensure discipline, automate your investments through your brokerage or investment platform. Set up recurring transfers and purchases to take the emotion out of investing.

Step 5: Monitor and Rebalance Your Portfolio

While DCA is a hands-off strategy, it’s important to periodically review your portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalancing involves adjusting your asset allocation to maintain your desired mix.

By following these steps, you can effectively implement a dollar-cost averaging strategy and work towards achieving your financial goals with reduced risk and greater peace of mind.

Real-World Examples of Dollar-Cost Averaging in Action

To truly appreciate the power of dollar-cost averaging (DCA), let’s explore a couple of hypothetical yet realistic scenarios that demonstrate how this strategy can work in practice.

Example 1: Investing in a Volatile Stock

Imagine you decide to invest in a technology stock that experiences significant price fluctuations. Instead of investing a lump sum, you invest $500 per month for 12 months. In months when the stock price is low, you purchase more shares, and in months when the price is high, you purchase fewer shares. Over time, your average cost per share is likely to be lower than if you had bought all the shares at once when the price was at its peak.

Example 2: Saving for Retirement

Consider an individual who contributes $200 per month to their 401(k) retirement account. This consistent investment, regardless of market conditions, is a classic example of DCA. Over the course of their career, they accumulate a significant portfolio, benefiting from the averaging effect of buying more shares when prices are low and fewer when prices are high.

- Reduced Stress: DCA helps investors stay calm during market dips, knowing they are buying at a discount.

- Long-Term Growth: Over time, DCA can lead to substantial portfolio growth, especially in investments that appreciate over the long term.

- Suitable for All: DCA is a strategy that can be used by investors of all ages and income levels.

These examples illustrate how DCA can be a practical and effective approach for building wealth over time, regardless of market volatility.

Potential Downsides and Limitations of Dollar-Cost Averaging

While dollar-cost averaging (DCA) offers numerous benefits, it’s important to recognize its potential drawbacks and limitations. Understanding these can help you make a more informed decision about whether DCA is the right strategy for you.

Opportunity Cost in Rising Markets

In consistently rising markets, DCA may not be the most optimal strategy. By spreading your investments over time, you could potentially miss out on the gains you would have achieved by investing a lump sum at the beginning. Research suggests that lump-sum investing tends to outperform DCA in such scenarios.

Requires Discipline and Patience

DCA requires consistent execution and patience, which can be challenging for some investors. It’s essential to stick to your investment schedule even during market downturns, which can be emotionally difficult. Without discipline, the benefits of DCA may be diminished.

Not a Guaranteed Path to Success

While DCA can reduce risk, it’s not a guaranteed path to success. The performance of your investments still depends on the underlying assets you choose. If your investments perform poorly, DCA won’t necessarily prevent losses.

- Market Timing: DCA is not a substitute for careful investment selection.

- Inflation Risk: Spreading investments over time can expose you to inflation risk, as the purchasing power of your investments may decrease.

- Transaction Costs: Regular investments can incur transaction costs, which can eat into your returns over time.

In conclusion, while DCA is a valuable strategy for reducing risk and promoting emotional discipline, it’s essential to consider its limitations and weigh them against your individual circumstances and investment goals.

| Key Point | Brief Description |

|---|---|

| 💰 Reduce Investment Risk | Invest a fixed amount regularly, regardless of price. |

| 🧘♀️ Emotional Discipline | Avoid making emotional decisions during market swings. |

| ⏱️ Long-Term Focus | Stay focused on long-term goals, not short-term noise. |

| 📈 Consistent Investing | Regular contributions build wealth over time. |

▼

DCA is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price, to reduce the impact of volatility.

▼

By spreading purchases over time, DCA minimizes the risk of investing a large sum right before a market downturn, averaging out the purchase price.

▼

DCA is most effective in volatile markets, as it helps to smooth out the average cost per share over time, providing a more stable investment outcome.

▼

In consistently rising markets, DCA might underperform compared to lump-sum investing, as you could miss out on potential gains by spreading investments.

▼

Start by determining a fixed amount to invest regularly, choose your investment vehicle, set a schedule, and automate your investments through your brokerage.

Conclusion

In summary, **dollar-cost averaging** is a powerful tool for managing investment risk and promoting disciplined investing. While it may not always outperform lump-sum investing, its psychological benefits and risk-reduction qualities make it an attractive strategy for many investors, especially those new to the market or concerned about volatility.